|

This is the Friday GAB, your weekly round up of all the happenings in and around the group benefits industry.

This is a spoooooooky Friday, Friday the 13th. And it's a spooky update. Many of the provinces have released the fee guide updates and like inflation numbers, they are scary! Most provinces are 5% or more and out most populated provinces - ON and Quebec are above 8% Commentary on fee guides coming next week (probably). In not so spooky, shall we call them classic updates, we have M&A activity. Neil & Associates are officially welcoming the team from Rubbix Risk & Wealth Management under the Neil & Associates name. Connex Health Consulting has sold the operations of the Benefits Breakfast Club and the Benefits and Private Healthcare Associate program to Crosslinks. Connect Health has some educational webinars coming up loaded with CE credits which you can find on their website. And that's your Friday GAB. Did I miss something? Send me an email! This is the Friday GAB, your weekly round up on the happenings in and around the group benefits industry.

Let’s spill the tea. Over the break I wasn’t spilling the tea instead it was a steady stream of pina coladas. There was a Christmas miracle and I was one of the lucky few who flew out of YVR. Needless to say I missed most of the happenings that week. But did catch that Desjardins is teaming up with TELUS Health to expand access to health and wellness services. Also during that time Gallagher snuck in one last acquisition for 2022 and Buck joins the gang there. Empire announced an agreement with Medaca to improve disability leave management. Not a lot to share from this week. Co-operators announced that they are acquiring Smart Employee Benefits Inc (SEB). If you’re not familiar with them you should read the release, but SEB is an Insurtech company focused on Benefits Administration Technology driving two interrelated revenue streams – Benefits Solutions and Technology Services. Short and sweet for the first short week back so you can get back to your 5am wake up, mediate, gym, gratitude journal, and new year new you morning routine. That’s your Friday GAB. This is the Friday GAB, a place where the group benefits tea is shared weekly.

It's been a minute since the last GAB, apologies for leaving you thirsty. Partly news has been light, and partly I've been busy. People often ask me how I manage to post every week and the truth is sometime I don't. This week's tea is hot. Everyone's favorite travel provider for employee benefit plans has announced they are exiting the Canadian group benefit travel market. Allianz will continue to accept and support new claims until June 30, 2023. Allianz supported many insurers including some of the "big 3". Insurers won't leave you high and dry. They are busy finding new partners to support this key benefit. In really funny timing Benefits Canada published an article this week about travel insurance. The author writes "The group contract that’s included in most benefits plans doesn’t have any pre-existing condition clauses so it’s a much more comprehensive coverage." This can easily be misinterpreted in a way that leads one to believe group benefit travel will cover any out of country claim. But Group travel is still targeted towards the unforeseen and unexpected. A lack of written pre-X doesn't mean that there is not language in the contract to prevent non-emergent or expected/foreseeable claims from being reimbursed. Please read and understand you unique travel contract. Also in third party employee benefit news, and also travel related... Travelex Insurance Services announced an expansion into Canada. Meanwhile Allstate and APOLLO announced layoffs. The province of Ontario announced a reduced reimbursement amount for virtual healthcare visits. The significantly lower reimbursement amount will mean that many virtual care providers will not have a viable business structure and will shut down. With a Canada-wide shortage of primary care, this is a big blow to individuals, especially lower income earners and parents. In employee benefit insurance news, PBC announced Sarah Hoffman as their President and CEO. Sun Life announced a Family Building Program. Important to note that many of the services included in this program - fitness classes, vitamins, fees - are not insurance items and not an allowable expense according to the CRA. This means they are taxable benefits to the employee upon use. I like that the industry is expanding beyond insured, non taxable benefits. However, this will add complexity to the delivery of benefits. Communicating that when used a benefit is taxable will be challenging for plan sponsors and group benefit advisors. Employees may end up with an expense that they did not account for. Last, the feds finally announced the go date on the extension of EI sickness benefits. The date is Dec 18. The benefit payment period will be extended from 15 weeks to 26 weeks. Que the LTD amendments. And that's your Friday GAB This is the Friday GAB, your go-to weekly round up of all the things happening in and around the group benefits industry.

Let's get at er. Being a short week it was a slow news week. People were busy being productive not announcing new things, or perhaps the turkey hangover was just too much. There was NO M&A activity this week. Well there was, but it was P&C not group related. It's been a while since we has an acquisition free week. Partnerships are alive though. The good people at myHSA announced they are partnering with Dialogue. This partnership will bring mental health, primary care, employee assistance and wellness programs to employees. Older partner news, but something I missed is that GSC is partnering with Haleo, North America's leading virtual sleep clinic. And that's it. That's the Friday GAB. This is the Friday GAB. Your weekly round up of all the things happening in and around the group benefits industry.

I've been MIA for a few weeks and missed all kinds of great updates. There were a few big acquisitions like Capri and Rogers merging under a new name and StoneRidge acquiring the group Biz at the MultiCare Group. I missed the Benefits Canada Healthcare Survey webinar. But I'm on the advisory board so I had a sneak peek into the report months ago. Still, a fav of mine. I'll write my top takeaways from the survey soon. I also missed the Equitable Life Road Show. I LOVE industry events and this one stung as it's my day job too. Equitable Life also dropped a ton of product updates 1. Gender Affirmation product - optional for employers to add. And a third gender box will be added to all forms as the default instead of being available on request. 2. enhanced iCBT product available to all Equitable Plan members effective now 3. Partnership with Opifiny - Opifiny is an online platform that streamlines the disability claims process for consulting physicians, benefits plan sponsors, and disability plan members. Equitable Life will be using Opifiny for ongoing disability claims management, modernizing the process of gathering medical assessments and information. Not a new product drop, but I want to remind everyone that pharmacogenomics coverage is available not just with Equitable Life but with lots of carriers. Ask your AE what options are available. Equitable for example makes the product available to any plan member for a reduced cost or has an option for employers to add the coverage. And pharmacogenomics are claimable under the HSA. This benefit is flying under the radar big time and is an affordable talking point. Manulife and PPI recently shared some case study and ROI from their partnership. Moving onto other insurers Desjardins and GroupSource also just dropped their gender affirmation products. Everyone's is super different to talk to your AE and get the details. Desjardins also released a very very excellent tool for plan sponsors to better understand the product, and why they would offer it. A must watch for everyone really. It's an unlisted YouTube link so you'll need your Desjardin peeps to share it with you. I don't usually share much people news because it's just too difficult to keep track of but Desjardins also announced on Wednesday that any Ferguson has been appointed VP of Business Development. And the Benefit Alliance Group has a new President - Carolyne Eagan. Big congrats to Amy and Carolyne! RBC launched a helpful billing update. Now plan sponsors will be provided a list of employees that have become eligible for coverage above the NEM. If you're in Calgary or Vancouver to want an excuse to travel to one of those places and want some CE credits. CGIB is hosting two CE packed education days. You can find out more here. Sun LIfe caused a stir when they shared a go-date for the proposed change to the EI duration period. This caused a flurry of questions to insurers from advisors. But I think an effort to be helpful was more a hinderance as we STILL DONT KNOW! And the date they shared isn't' the for sure go-date. It can't be until the government says it is and they haven't. Here's what I know from our recent meetings with CLHIA. EI Extension Timelines:

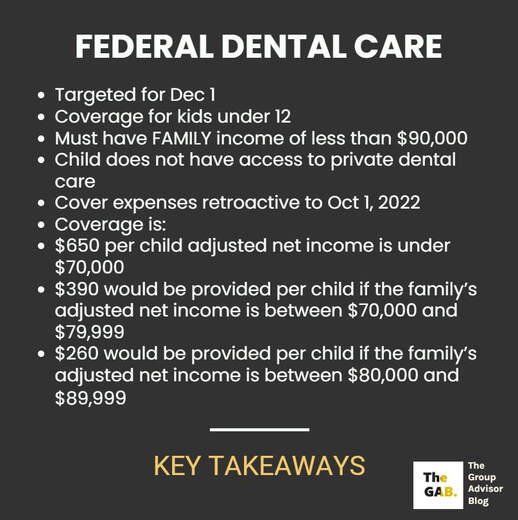

EI remains an unmanaged plan so from an industry perspective, we still believe in the value of having an STD program in place and in having a shorter waiting period for LTD. There might be changes to some plans because of the EI extension (this would include adjusting carve out plans to 26 weeks, and possibly offering changes to LTD elimination periods). Plans will most certainty need to be updated to qualify for the rate reduction program, but it's likely the government will allow a long lead in for plan sponsors to make changes to their STD. In summary, while there is information available, nothing is concrete so far. Most insurers are looking at making changes to their plans. In other fun government news, Alberta is going to regulate psychedelics for therapy. Before you get excited and start asking insurers if they will coverage these drugs, the answer is no. Right now they are still illegal substances. Doctors and researchers can apply to Health Canada to use them in clinical trials and get special access for therapy. Insurers will have to build a prior authorization process to allow cover for these drugs on group benefit plans. But I don't know why they would bother for only one province where a small number of physicians will be able to treat patients. The effort to do include coverage under a group benefit plan isn't worth it (yet - looking at you Ontartio). I'm sure there's lots more to share but this is getting long so that's the Friday GAB. Happy Thanksgiving. This is the Friday GAB - a weekly round up of all the things happening in and around the group benefits industry. It's been a quite week... with the exception of one big government announcement. The industry had a sign of relief as the mystery behind the federal dental plan was sort of revealed. Here are the details as reported by CTV News. Federal dental plan phase 1 will provide eligible parents or guardians with "direct, up-front tax-free payments to cover dental expenses." However, in order to access the benefit, parents or guardians need to apply through the Canada Revenue Agency (CRA) and attest that: 1. Their child does not have access to private dental care coverage; 2. They will have out of pocket dental care expenses for which they will use the benefit; and 3. They understand they will need to provide receipts to verify out of pocket expenses occurred if required. Before you email your insurer to remove dependents under the age of 12... Remember this is ONLY for those with a FAMILY income of $90,000 or less. The median family income in Canada is $90390. The benefit amounts announced in this federal plan are far lower than what an average group plan would offer. *Median is the middle number in a group f numbers. Where a median income of $90,390 is given that means that exactly half of the incomes are greater than or equal to $90,390 and that the other half is less than or equal to $90,390. The next phases are children under 18 and senior. The commitment is to expand the program to these groups by the end of 2023. A few more details - The first phase of dental care will provide eligible parents/guardians with a bridge payment - a direct, up front, tax free payment to cover dental expenses. Parents/Guardians will need to apply. Health Canada and the CRA are collaborating closely on an application platform that would deliver payments in a timely fashion. When applying, one will have to attest that - their child does not have access to private dental care coverage, they will have out of pocket dental care expenses that they will use the benefit for and they understand they will need to provide receipts. Because we can't go a single week without M&A news, congratulations to the team at Montridge Advisory Group who has been acquired by Westland.

Last for this week - in person events are very much back! DisruptHR Edmonton and Calgary have both announced event dates. And the CGIB also has some in person sessions coming up. A week and a weekend from today, the Equitable Life roadshow kicks off in the West with A Burnaby stop on Monday Sept 26, followed by Edmonton, Calgary, Winnipeg and Saskatoon. The following week the ON sessions will begin (message me if you forgot to registered and want to come) And that's the Friday GAB. This is the Friday GAB. A weekly roundup of all the things happening in and around the employee benefits industry.

Let's get at it! Rarely a week goes by without some kind of M&A news. This week is no different with AGA Benefit Solutions acquiring Aptus Benefits and Major Group acquiring BCI Benefits Coordinators. Cloud Advisors announced a relaunch of their platform that opens it up to the public. They now have open marketplace to access for employer across Canada. Employers can now peruse the marketplace at no change and purchase employee benefit products. You can read all about there update here. There are a few product updates. On Oct 1, GroupSource is changing optional life/ad&d insurance and AD&D provider to Empire Life. This is a pretty low impact insurer change. RBC and PocketPills have teamed up to offer 100% coverage for medications until Feb 28, 2023. You can read the fine print here. If you do market this to your RBC clients and plan members PLEASE communicate well and often and read the fine print! And then communicate well and often again as you approach the end date. Without strong communication, and perhaps even with it, I predict many plan members being very angry that they are paying for their drugs "all of a sudden." Need help with communication? Read this. Last, not official yet but as predicted the news outlets are reporting a $650 bridge payment for the national dental program this year. For the love of the Queen, please don't start cancelling dental plans to try to shift to this. Today it's only for kids under 12. Tomorrow for seniors who likely aren't working anyway. We're a long ways away from it being available for all people (without access to benefits). Plus it's only for FAMILY income of $90,000 or less. That's about half of Canadian households and it will leave employers responsible to track family income. Maybe the insurers will build some kind of carve out plan when this goes live for all people. Anyhoo, read about the Bridge Payment info that was leaked here. And that is the Friday GAB Welcome back! This is the Friday GAB, a weekly round up of all the news in and around the group benefits industry. As much as I try to be, I’m not an all seeing Seer yet, so you’ll need to let me know what news I have missed. Since I’ve been off enjoying the dog days of summer this is more of a summer round up. Since it’s a bit longer it’s more to the point than usual. Summer slow down? What summer sloe down said the M&A space. We had Hub make an acquisition, TELUS of course picked up LifeWorks, Selectpath (Navacord) picked up Thrive Benefits Group, and Navacrod was busy acquiring CHS Benefits and they also partnered with ONYX in Manitoba, last Westland acquired the Winch Group. In product news, RBC added gender affirmation (rumor has it Equitable Life will launch their product in about a month), and partnered with Smile Direct. Side bar – I *love how RBC is controlling their AE’s LinkedIn and all of their posts are launched at the exact same time and are exactly the same. Social media is kind of sucky these days. GSC also had a busy summer announcing their partnership with KITS Eyecare, and lunching their new small group product through Honeybee. Medavie launched text therapy and had a few other updates Back in July Manulife moved coverage for the Dexcom 6 CGM to fall under the drug coverage. Not to be left out of the announcement pool Sun Life delayed the date change from TELUS Health to Express Scripts by another month. Drug card switchovers are obviously a large project. In other news, Dialogue reported increased revenues… and losses. From Betakit “Dialogue Health Technologies reported an increase in revenues in the second quarter of 2022 to $23 million CAD from $16.6 million CAD for the same time last year. However, the health tech’s losses also increased from $6.6 million CAD to $8.2 million CAD for the quarter”. Rise People partnered with OneVest to create a private, fully integrated wealth management offering on the Rise platform. The Employee Wellness Solutions Networks has a Workplace Wellness Champion Series going on that is free to register for and the program has been approved for 4 CPD hours for the HRPA. Finally, the BC Chapter of the ISCEBS is looking for volunteers. That's the Friday GAB. Welcome back to the Friday GAB. A weekly round up of the group benefits insurance news. Up this week, Empire Life was welcomed by Exos Wealth Systems Inc as a minority shareholder. I've noticed that as brokerage consolidated has been happening insurers have been getting into the space as well. Equitable Life made another exciting product announcement. That's two weeks in a row for them. This week is the official go-date (June 19) for the switch to TELUS Health eClaims for paramedical and vision claims TELUS Health eClaims has an expansive network of health providers across Canada. They have partnerships with more than 70% of all paramedical and vision providers. That means many more plan members can enjoy the benefits of direct claims submission. Last, earlier this week Sun Life shared they are experiencing another claim submission outage. You can check for updates here |