|

10/5/2022 I read it so you don’t have to – Striving for balance, advocating for change – The Deloitte Global 2022 Gen Z and Millennial SurveyRead Now  I read it so you don’t have to but should anyway– Striving for balance, advocating for change – The Deloitte Global 2022 Gen Z and Millennial Survey This survey connects with respondents around the globe to gauge their views about work and the world around them. Let’s dig in! _________________________________________________________ The recap is that people feel burnt out but are still pushing - taking on second jobs and pushing for more meaningful and flexible work. The executive summary is excellent and a really quick read – if you read anything read that. This year’s survey found that Gen Zs and millennials are deeply worried about the state of the world and are fighting to reconcile their desire for change with the demands and constraints of everyday life. They are struggling with financial anxiety, while trying to invest in environmentally sustainable choices. And they are pushing their employers to be more proactive in the fight against climate change. The report is broken into 4 categories:

Aligning with Gen Zs’ and millennials’ values is key. Nearly two in five say they have rejected a job or assignment because it did not align with their values. Meanwhile, those who are satisfied with their employers’ societal and environmental impact, and their efforts to create a diverse and inclusive culture, are more likely to want to stay with their employer for more than five years. 90% are making some effort to reduce their own impact on the environment and many are willing to pay more to make sustainable choices. They want businesses, and their own employers, to do more. Only 18% of Gen Zs and 16% of millennials believe their employers are strongly committed to fighting climate change. Gen Zs and millennials want to see employers prioritize visible climate actions that enable employees to get directly involved, Employers do seem to be making progress when it comes to prioritizing mental health and well-being in the workplace. More than half agree that workplace well-being and mental health has become more of a focus for their employers since the start of the pandemic. However, there are mixed reviews on whether the increased focus is actually having a positive impact. The cost of living is the top concern among Gen Zs and millennials followed by climate change. After that, top concerns change between the two generations. The younger cohort are concerned by unemployment, mental health, and sexual harassment. Personally, I’m glad to see sexual harassment on the list as is shows a lack of tolerance for historical bad behaviour and makes me hopeful for systematic change in this space. Millennials are concerned about their healthcare and disease prevention. This is a signal to employers, and something that the employee benefit plan can tackle. With large portions of these generation taking on second jobs and with 47% living paycheck to paycheck it’s not a surprise that burnout is high. 26% and 31% are not confident they will be able to retire with financial comfort. There is an opportunity for employers to make these generations feel more secure by offering a Group RRSP program with contribution matching or a Tax free spending account where they can use the funds to repay student loans. Respondents also shared that working remotely has helped them save money. The way things were, is not the way things are. Loyalty to the employer is waning. "would like to leave their jobs within 2 years"

Public facing industries are especially at risk for high turnover and industries such as consumer and retail are already experiencing labour shortages. But what can employers do to attract and retain talent? When people feel their voices are heard, they tend to feel more connected and loyal to their organizations. You can’t EAP your way out of burnout: 53% of Gen Zs and 51% of Millennials agree that their organization talks more about mental health now, but this has not resulted in any meaningful impact on employees. Only about 1/3 said they would not feel comfortable speaking openly with their direct manager about feeling stressed or anxious or about other mental health challenges If you’re not addressing the core issues of burnout – work loads, feeling of purpose and feeling valued, no amount of mental health communication will help. When most respondents top source of stress is financial, employers need to do more than offer a few mental health resources. They should assess if their total compensation packages are meaningful One of the most direct actions organizations can take to address wealth inequality is to focus on supporting their own people. By understanding employees’ priorities, organizations can align benefits and compensation accordingly. Low hanging fruit could be increasing the employer paid portion of the group benefit plan or adding a healthcare spending account. Another key factor is focusing on closing the pay gap, which will include working to ensure that women and minorities are represented at all levels, and that they have equal opportunities to grow. End. 9/2/2022 Change and risks in employee benefits – what is the cost of doing nothing and why is no one updating their group benefit plan?Read Now Risks in employee benefits – what is the cost of doing nothing and why is no one updating their employee benefit plan? (This is a long one!)

Let’s talk A little about change, everyone’s most beloved activity. Doing nothing is easy. Doing nothing is all about change. And Not changing seems easy. Historically in the benefits biz, change has been driven by outside forces. not by innovation from within. Pharma manufacturers releasing high cost drugs for rare disease, pharma releasing high cost drugs for less rare disease. Employer pressure in Alberta for more tools to compete for employees. Supposed disrupters, COVID, consolidation, government policy, the list goes on. COVID for example has pushed the insurance digital revolution forward at least 5 years. External change drivers are a risk as it puts the group benefits industry in a position where it’s reacting. We’re passengers in the change vehicle instead of drivers. Group Benefits Insurers and group benefits advisors need to become drivers and I think we are seeing the beginnings of this. Back in 2016 when Canada Life was still GWL, they told the people attending the Benefits Canada’s Face-to-Face Drug Plan Management Forum the 90% of their clients hadn’t changed the design of their drug plan during the last 10 years. I guarantee you, six years later that this stat is unchanged. Don’t believe me? Here are a few more stats. The Gallagher Driving Data with Decisions Survey found that 62% of plan sponsors have no plans to make updates to their benefits programs. Let’s give that more weight. In a weird coincidence, the 2022 Benefits Canada Survey also found that 62% of employers made no changes to their benefit program. And of those who did, 7% reduced their benefits. Why is this? Why aren’t employer making simple updates to their benefits program? Why as an industry are we letting outsiders drive change? The book Stop Selling and Start Leading nicely lays out this journey. I’m going to use the term buyer now. The buyer is different depending on the context. As an insurer, the advisor is the buyer, maybe the plan sponsor too. For an advisor the plan sponsor is the buyer. You perhaps you’re reading in the context of being the buyer. When we sell, and when we propose options to people what we’re doing is asking them to change. We all have a limited amount of bandwidth which means we need to factor in which actions are worth doing. This is part of why the status quo is so appealing. Thinking about the change journey, First the buyer will need to convince others inside her organization about the choice. That may involve conflict, debates, tradeoffs, promises and uncomfortable questions. Next the buyer will need budget approval. that choice to allocate a portion of it to your solution means foregoing some or all of something else. This means saying no other others who are advocating for those resources. It may mean severing ties with another vendor who also has a relationship and history with the company. Once everyone is convinced and the budget is approved, there’s even more work to do. The buyer must coordinate or delegate all process, staff training, alignment, and set up. The buyers decision will be scrutinized. And they will have to deal with push back and complaints that come with change. All this requires the buyer to take risks, to dedicate time and energy to the change and to disrupt other work. No one makes those kinds of sacrifices unless they feel competent, confident and committed. We need to create the conditions for buyers to feel supported and enabled. How does one accomplish this? By Being available, being responsive and being respectful. Be available – you’re the quarterback between the client and the implementation team. Educate, explain and answer questions. Keep everyone connected. Set expectations early and check in on them often. The buys needs to absolutely understand what is going on. Next Be responsive. If the buyer has concerns or doubts, don’t take them lightly. Confidence gaps can derail a project. Listen closely to pick up subtle clues Last, be respectful – two way dialogue that allows your buyer to participate in creating what they want so they will have a sense of ownership. People embrace new behaviors when the current behavior is really not working for them. The status quo becomes so uncomfortable that you feel compelled to break the inertia and try something new. We can get people to embrace new behaviours by offering a unique perspective on their business. Our insights have to be so compelling that the client is willing to go through the pain of change. Because we are selling change. The goal isn’t to convince a buying group to buy a solution. It is to persuade them to change their behaviors. I think we understand why people don’t change. What are the risks of not changing? It comes down to money and time. Money First. It’s simple you’re spending more money than you have to because of:

Time. It’s likely that you’re using up precious bandwidth and spending time doing things you don’t have to

While we’re on the topic of risk and change I’ll leave you with a few other risks to ponder.

End. In this past post I shared the Benefits Canada Healthcare Survey findings that employees who view their group benefit plan as quality are most likely to report also being satisfied with their job. The group benefits survey also finds that employees who are healthy are also more likely to find their group benefits meet their needs and also repot being satisfied with their job.

The group benefits survey also finds that employees are looking to their employer to support their physical, mental and nutritional health. But who is responsible for employee health? Employees seem to think their employer is. And a case can be made that it’s in an employer’s best interest to keep employees healthy. One must acknowledge that personal health is always to some degree the responsibility of the individual. But as individuals the info we receive (and “research”) is often conflicting and confusing. Again employees look to their employer to vet vendors and information so they can consult trusted sources without hours of googling. What about the government? Aren’t they responsibly for healthcare? Well yeah. The federal government made it their job to keep us healthy with the Canadian Health Act but have failed to live up to that promise. With family physician access akin to winning the lottery in some cities, wait times for specialist getting longer and longer, emergency centers closing and some people unable to afford drugs or dentalcare without an employee benefit plan, the burden of healthcare is for better or for worse seemingly shifting (shifted?) to the employer. If employers have by de facto become responsible for keeping working Canadians healthy, the next question is can they afford to continue to do so? And how will group benefit plans evolve to solve this? 9/2/2022 The way things were, is not the way things are. So why are we clinging to the 9 – 5?Read Now This isn't a group benefits blog post. It's more of a work perk, culture, burnout, examining why society is clinging to a work structure that's no longer working. I suspect it has a lot to do with not wanting to change and internal bias. I did a blog post about risk and change that applies to this situation.

We’re at a space in time where the classic 9-5 is being revaluated. Are there better ways to work? One of the ways being tested around the world is the 4 days workweek. Most think of this as a 32 hour week, not 40 hours condensed into 4 days. But that is an option being tested and applied as well. There’s other ways to rethink the 9-5, flexible working hours is one. But here I recap some of the findings on the 4 day week. Recently in the news was an update on the worlds largest trial of a 4-day workweek. Back in June over in the UK, over 3300 workers across 70 companies are taking part in the trial that gives workers 100% ay for logging 80% of their normal hours. Previous to this, Unilever, Panasonic, and Microsoft all did their own trials with great success. Microsoft said it’s experiment saw productivity surge 40% Iceland famously trialed the 4 day workweek with over 2500 public sector workers and it was an overwhelming success. the results found that a reduction of working hours maintained or increased productivity across all sectors in the economy. The findings also indicated improved wellbeing and work-life balance among workers. In 2018 a trial at Perpetual Guardian in New Zealand found engagement levels rose between 30 and 40 percent, work-life balance metrics rose by 44 percent, empowerment by 26 percent Why try this?

4 Day Week Global is a not-for-profit community that provides a platform for people interested in supporting a 4 day week as part of the future of work. Some of their findings include

This doesn’t come without any headaches – you of course have change management to deal with. Beyond that, figuring out the best new scheduling pattern will take some trial and error. You also need to consider what to do with employees who were already working on a reduced schedule. You also have to balance the pressure to perform in a shorter amount of time and the ability to track productivity changes… or do you? It’s also not a miracle fix. If burnout is a problem, it probably still will be. If you don’t address the core of the issue (in burnout’s case that’s complex – flexibility, feeling valued, the literal workload) a shorter work week won’t solve the problem. If you do want to try this 4 Day Week Global recommends:

Here's the recap on the large study happening now from CTV News The guy just wanted to enjoy his retirement with his dog.

You know those LinkedIn posts where people turn some mundane or annoying everyday experience into this epic life lesson? This is one of those. And it’s hilarious. Now stay with me. So I'm getting reacquainted with the John Wick Chapters. I know I’m early the 4th Chapter doesn’t drop until 2023. But I may have gotten a little excited because the trailer recently dropped. This guy? He’s the GOAT. But what makes Johnathan stand out in his field of work? Its certainly not a 4am wake up. His alarm is set for a more reasonable 6:00am. The thing I always appreciated about John wick the most is that the guy always double taps. As I'm watching, appreciating his double tap efficiency what I realize is he also does not hesitate. Then because I'm analyzing it now, he's also great at planning and anticipation. Because I love a good movies series binge, I immediately began to watch John Wick Chapter 2 I noticed that they start out similarly with John being described as a man of focus, commitment and sheer effing will. Okay what does this have to do with being an industry go-to and maybe even great client experiences? Everything. We can learn a lot from our pal John. Let’s “unpack” this. When John is in the field, he’s able to anticipate a person’s next move. In any field of work this is key to a great experience. Answering a question in an email? Anticipate what next steps your answer will create – is it a return question? Is it finding a document? Maybe it’s booking a meeting? What further task, activity or inquiry needs to happen? Anticipating this and tackling out of the gate creates a better, more thoughtful experience. This is where the planning comes in. John carefully plans and prepares for his jobs. Let’s think about the impossible task he’s given in Chapter 2 (spoiler alert it’s to assassinate a difficult to reach target). He prepares by reviewing blueprints and there’s a “fun” scene where he’s getting his bullet proof suit made and he’s gathering is weapons. Then we see him strategically stashing said weapons in key locations. He does this because he took the time to anticipate what actions will happen as a result of his actions. Akin to preparing for an important meeting, you take the time to learn about who is in the meeting and what they care about. You carefully prepare your messaging and practice what you want to say. You test your technology to ensure it runs smoothly and you spend time anticipating what actions will happen as a result of this meeting. What questions, objections, excitement, next steps will need to be addressed? Next up no hesitation. Now in John’s line of work, not hesitating means he stays alive because unlike every bad guy in the history of movies, John does not hesitate even for a second to pull the trigger. This aligns with the description of his as focused and committed. We all know that procrastinations creates in consistency. No hesitation means “paying yourself first”, “taking the bit out of the elephant” or whatever cliché slogan you want to use. It’s doing the work that’s most important with no hesitation. Staying focused on the one important task. Last we have the double tap. I view the double tap as a throughout completion of the work and a strong follow up to ensure a job well done. Simple. What do you think? Does John Wick really have the secret to success? The 2022 Drug Data Trends & National Benchmarks report by TELUS Health is a fan favorite filled with useful data. This year's report can be found here

TELUS shares that the growth rates for 2021 and 2020 occurred despite notable declines in the number of insureds who submitted claims during the first two years of the pandemic. So besides drug costs continuing to rise and should continue to be a focused area to reduce claim cost... My Top 5 takeaways are:

It’s worth noting that Not all carriers followed suit to mimic the government’s switching policy in order to avoid taking on the full cost of originator biologics for plan members who choose not to switch and instead turn to their private plan for coverage. In addition to paying the full cost of a plan member’s claim, it also opens the Employer/Plan Sponsor to COB risk. Last week I talked about the connection between the quality of a benefit plan and an employee’s satisfaction in their job and braggable benefits. You’ll recall my braggable benefits formula is

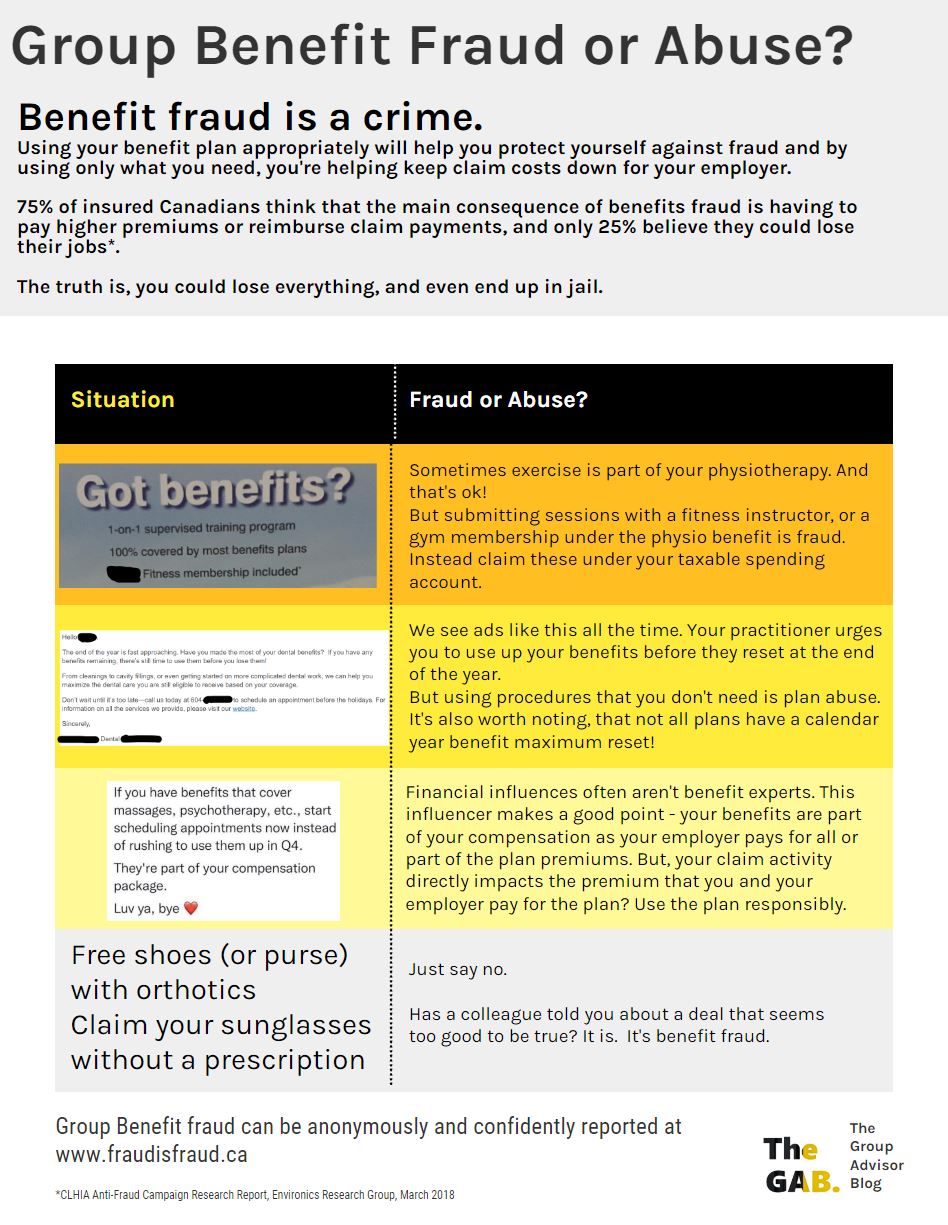

Braggable Benefits = Personalized + User Experience + Digital + Communication The key here is communication. Communicating the benefit program is one of the most impactful things employers can do. Why? Well 83% of employees believe that their employer pays a fixed cost to the insurance company, no matter how much or how little the benefit plan is used. This means that some employees may use benefits that they don’t need because they think there are no consequences in doing so. Plus 58% pf employees are just unaware of their benefit entitlement. This means, employees who may need care, aren’t getting it because they don’t know they can. This could lead to turnover (due To a lack of perceived care form their employer) absenteeism, disability, higher long term drug costs or worse case scenario, an unclaimed claim for a benefit like CI. Communicating the benefit plan doesn’t have to be a big task. Here are some tips to get you going. Start by communicating a summary of what you have in the benefit plan. There’s lots of nitty gritty programs like health risk assessment, and iCBT built into plans. If you’re not sure what perks your insurers have included ask your advisor or your Group Account Executive. Next, Communicate what’s free in Canada

Everyone has a lot of communication coming at them all day, every day. So keep your short and sweet. When you communicate is small but frequent bursts, your message is more likely to be received. Also try communicating in different ways, in person employee meetings, email, posters, mail, webinar, intranet and so on. What is a short communication? This post isn’t. In person, it could be a short as quickly mentioning a service. In writing it means keeping message length equal to no more than one mobile screen. When people have to scroll to read the while message, they move on without reading. Last, when possible bucket communications into structured buckets. For example

That’s it! What communication tips do you have? 58% of employees are unaware of their benefits entitlement.

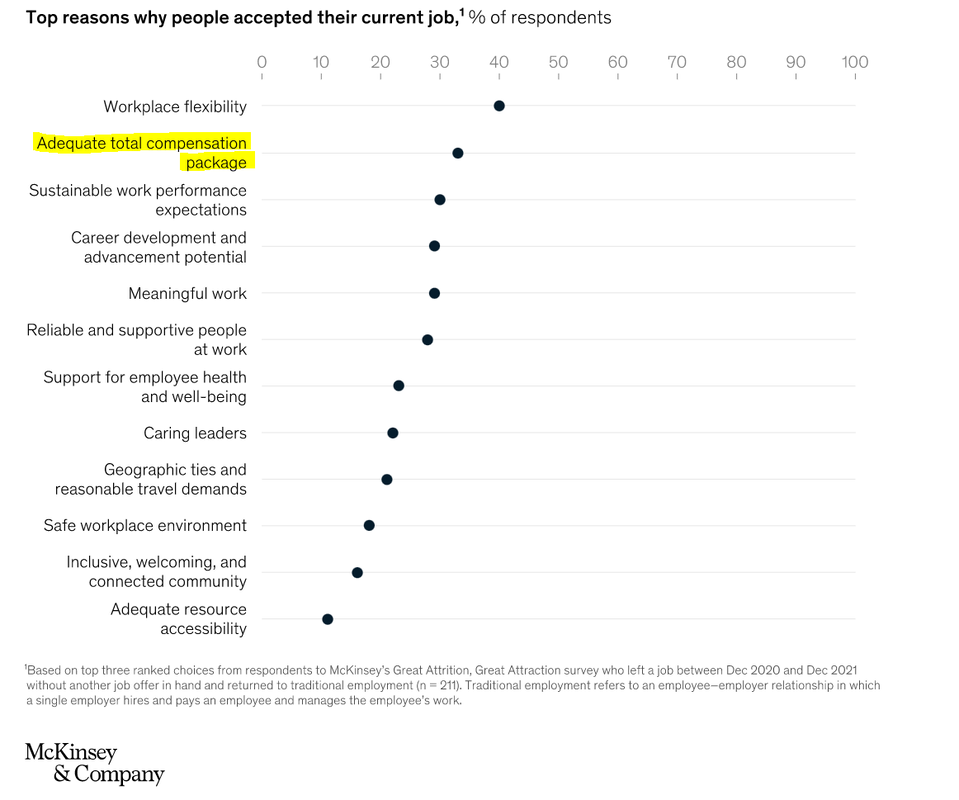

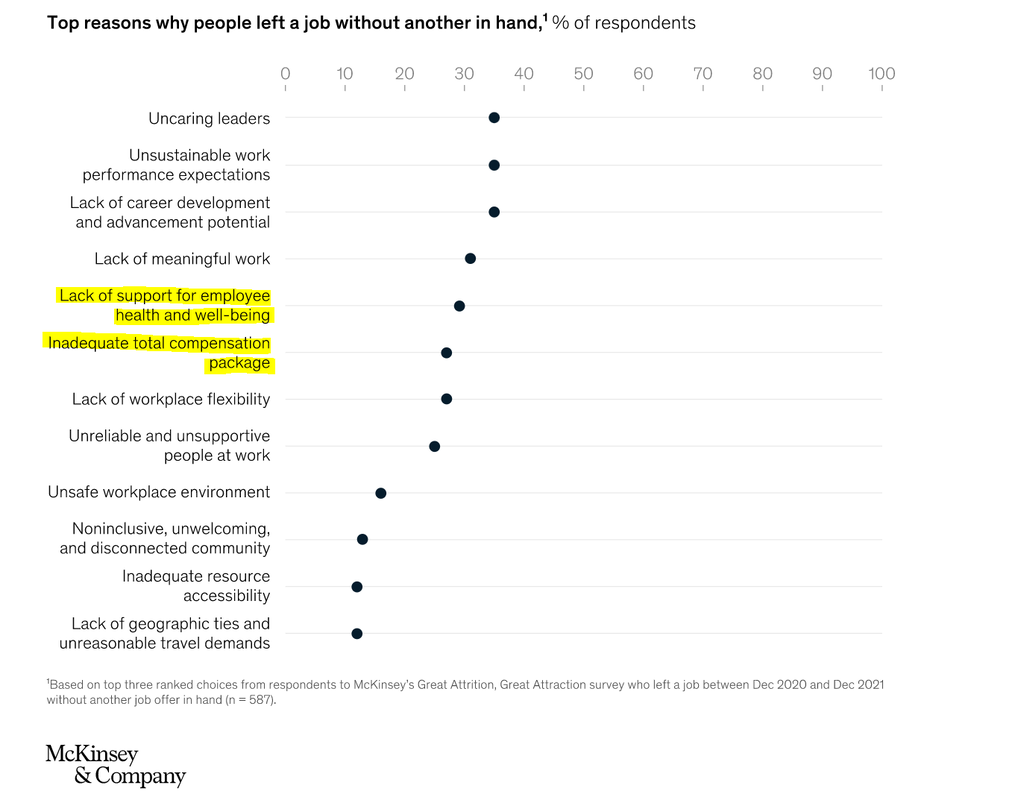

That means that not only do employees not know what benefits they have, when or how to use them, but they also don’t know how much their employer pays for them. So what? I talk about braggable benefits a lot. In the sense of employee’s bragging to other about their awesome benefit plan. But employers can and should be bragging about their benefits to current and new employees. It’s story time. Once upon a time, in the province of Alberta, an advisor shared this story with me. One of their clients had an employee leave to go to a competitor for an extra $2 / hour. Same work, we’ll call it a similar commute, just more money in their pocket. But after a week in the new job, this employee asked tier employer for their old job back. Why? Working conditions were fine, the people were fine, management was fine. This employee was making more money. So why, after a week would they ask their previous employer for their old job? It was the benefit plan. Specifically, the cost share in the benefits plan. You see the new employer was paying for half of the plan, where as this employee’s previous employer was paying for 100% of the plan (I’m sure with the exception of disability premiums). And that, was worth way more than the extra $2 per hour. The group benefit program is an important part of the total compensation package, and employers should be bragging to current and future employees about not only the benefits they provide, but also how much they contribute to the cost. This small feature can be the difference between an employee staying or going, coming on or choosing another employer. Need extra proof in the pudding? I have some delicious pudding for you care of McKinsey & Company. Their study found that after work flexibility the top reason why people accepted their current job was an adequate total compensation package. That of course includes benefits. And for those who left, a lack of support for employee health and well-being followed by inadequate total compensation are #5 and 6 on the list. What’s the best way for employers to brag about their benefit plan? The chicken and the egg, which came first?

It’s kind of like that with employee job satisfaction and a quality benefit program. You see year over year, the Benefits Canada Healthcare Survey has found that employees who have a benefit program that meets their needs or view their benefit program as quality or have a workplace wellness culture, or a workplace that supports mental health, are more likely to be satisfied with their job. In 2020 the survey found that 87% of people who viewed the quality of the plan as excellent/very good were also satisfied with their job. In 2021 the stat dropped a big, likely due to healthcare needs changing due to COVID and the initial shock of working from home and managing the family. In 2022 you’ll see that number bounce back with the survey drops this fall. I love this statistic. It makes the case for great benefits, or braggable benefits as I like to call them. Braggable Benefits = Personalized + User Experience + Digital + Communication The backbone of braggable benefits is communication. When employees know what benefits they have, when and how to use them they are more likely to be satisfied with their plan. But at the same time, I have been thinking … Does the quality of the benefit program make people satisfied, since they feel seen and cared for, or are the satisfied people simply wearing rose-coloured glasses and less likely to complain? Dose the plan meet their needs because they don’t need the plan? Perhaps those who are stressed and in poor health unable to navigate their benefits due to a lack of bandwidth. Maybe one does not lead to the other and instead they are intertwined like an infinity symbol. |