|

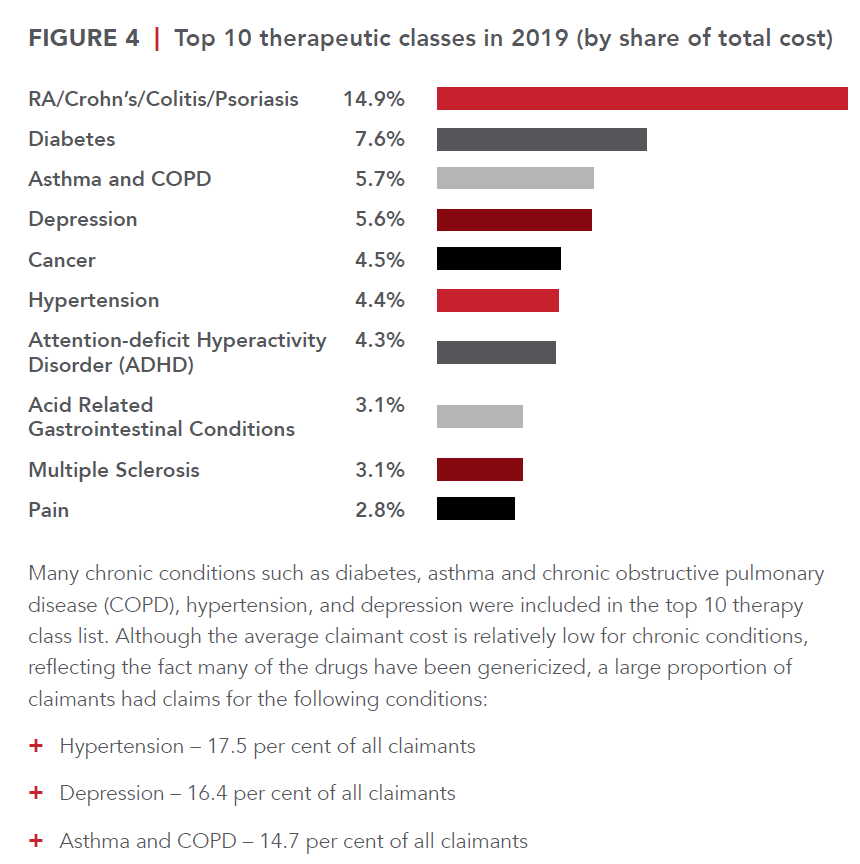

12/6/2020 I Read it, So YOU Don’t Have To the 70 page goodie from HBM+: 2020 Drug Trends and Strategic InsightsRead Now  In this episode of I Read it, so YOU Don’t Have To is the 70 page goodie from HBM+: 2020 Drug Trends and Strategic Insights. You can access this report here. I recommend viewing the many visuals and reading the section on drug formularies: page 44-48. Ready?! Let’s dive in. Who is HBM+? One of the largest pharmacy and health benefits managers in Canada, HBM+ is a division of Green Shield Canada. The data presents drug claims and utilization data for their six partner insurers and third party administrators (TPAs), representing over two million claimants, and over $1.5 billion in annual adjudicated drug cost. These are their insights (peppered with my commentary of course). If you have read any drug claim report in the past, you’re familiar with what’s about to come. Drugs costs are rising, high costs drugs are a problem. Etc, etc. So here it is again. Only this time, let’s take action after reading this. Since 2014 drug trend ranges from 4 to 14.2% (taking out the OHIP+ blip year where the Liberal government shifted all drug claims for those under age 25 to the province only to have the Ford government quickly reverse that initiative). The average drug cost per claimant rose from $61.90 in 2015 to $66.00 in 2019. Not noted here, but in other reports is the dramatic difference between the average provincially. This highlights how well provincial drug programs reduce the cost burden on employers. Atlantic Canada has by far the worst average drug cost per claimant and this is directly related to their lack of provincial drug coverage. The average annual cost per claimant for the top 5% was $8,306 in 2019, which was more than 21 times that of the other 95% of claimants ($392). The top 5% of claimants had an average of 66 claims in 2019, versus just nine claims for the other 95% of claimants. The top 1 % of claimants have an average annual cost of $24,740 which is 31.4% of the total drug costs. This is where we can get a lot of bang for our buck with biosimilars (and a drug formula plus provincial drug plan alignment). Many of these high cost drugs are not just biologic claims, but originator biologic claims. Call to action: Group Benefit Advisors must begin to have proactive risk conversations with employers around biologic drugs. As we see the provinces delisting many originator drugs, not all carriers are following suit making this the risk conversation with employers vital. When an insurer does not also delist a biologic drug, it puts additional risk and unnecessary claim pressure on employers. BC has already delisted a bunch of originator biologics Most insurers in BC also delisted, but a few held out forcing employers to pay for these expensive drugs when the provincial program should have picked up the cost. More on this in the biosimilar section. Generic drugs have been and continue to be an important source of savings for drug plans. Generic penetration rose to 62.5% in 2019 from 55.3% in 2015. There is room for improvement. Call to Action: If your plan doesn’t already have a lowest cost alternative or mandatory generic substation built into it, what are you waiting for? Do like to spend more for the same product? The generic price negotiations between Canadian Pharmaceutical Alliance (pCPA) and the Canadian Generic Pharmaceutical Association were key. For some generic molecules, the price was reduced to as little as 10% of the brand-name equivalent They say a picture is worth a 1000 words. I think this graph speaks for itself. While the top drug category is concerning and cannot be ignored, there’s a lot we can do to reduce claims with a healthy lifestyle in other categories. The average cost per claimant for diabetes is $981 and there are 119,168 claimants. While hypertension has almost 350,000 claimants with a cost of $197 per claimant. We can make significant improvement to claim costs if we proactively tackle these conditions. Call to Action: what proactive plan design is in place to promote health? What wellness initiatives are built into the employee’s experience? In 2019 18,200 claimants used a specialty drug. This represents growth of 11.2% over 2018. This is not sustainable and represents a huge risk to benefit plans. The arrival of biosimilars offers incredible opportunities for savings while maintaining plan member access to effective drug therapy. Another cost management strategy that has been successfully employed to manage specialty drug expenditures is preferred pharmacy networks (PPNs). PPNs are an important tool to manage the pharmacy markup of specialty drug claims. As specialty drugs can cost over $100,000 per year, the pharmacy markup represents a substantial sum of money. PPNs are structured to not only reduce the standard pharmacy markup for these claims but also bundle additional value-added services such as adherence support and case management. When combined, these programs can control claim costs and ensure patients are appropriately using these high-cost therapies. Pharmacy Listing agreements are equally essential in the management of specialty claims. Since 2010, the pan-Canadian Pharmaceutical Alliance (pCPA), has utilized the collective buying power of the provincial drug plans (and the federal government) to negotiate drug prices for over 200 drugs. As of March 2019, the pCPA has been able to realize savings of over $2.26 billion annually. This effort has substantially enhanced the sustainability of public drug plans across the country. No such collective buying effort currently exists in the private sector. Shifting the cost of a high cost claim from the employer, to the public pan whenever possible is a key strategy for employer drug plans. Since 2014, 10 biosimilar products impacting private drug plans have been approved and marketed in Canada to treat a range of different conditions, including diabetes, Crohn’s disease, psoriasis, and neutropenia. Biosimilars present comparable safety and efficacy to their originator products, but at a significantly lower cost; in fact, the discount attributable to a biosimilar relative to a reference product is over 50% for some products. As private drug plans embrace biosimilar-first policies and biosimilar transitioning, biosimilar penetration is expected to grow substantially in the coming years. The benefits of these therapies for private drug plans extend beyond immediate cost savings, translating into better integration with public plans, many of which are starting to implement biosimilar switching policies. In particular, in 2019, British Columbia became the first Canadian province to implement a biosimilar transitioning program for all Residents that led to substantial savings for the public drug plan without compromising patient safety or access to drug therapy. Since then, Alberta has also announced the implementation of a biosimilar switching policy, and it is expected that Ontario will make policy decisions to move forward with a similar approach. Call to action: talk to employers about the risk of being insured by a carrier who has not also delisted these drugs. Most chronic disease sufferers claim for maintenance drugs on an ongoing basis, after initial effectiveness is established. It follows that maintenance drugs should be dispensed at three-month intervals to facilitate patient adherence and reduce overall dispensing fee costs. In 2015, 90-day supply claims made up close to 28% of the total number of claims As a result of the implementation of the maintenance medication dispensing frequency policy in 2016, the share of 90-day supply claims rose steadily over time before stabilizing at around 40% in 2019. In that same time, claims for 30-day supply dropped from 19.9% of the total number of claims, to only 10.5% Opioid management is an important topic since there is an epidemic of opioid overdoses. HMB+ notes that the issue is extremely completed and cannot be solved by one stakeholder alone. It will require a concerted effort among multiple partners, including health care providers, insurers, TPAs, advisors, plan sponsors, and pharmacy benefit managers. They go on to describe their three-component opioid management policy: focus on abuse deterrence, restrictions on long-acting formulations, and opioid medication utilization reviews. Implementation of this policy instantly lowered the number of claimants using oxycodone from about 160 in May 2017 to just 10 claimants in July. The drop in the number of claimants eventually stabilized at an average of just 17 claimants monthly in 2019. Managed formularies are one of the most effective, yet underutilized tools to drive value and cost containment. Managed formularies are based on the premise that drug prices are not always commensurate with the level of therapeutic value they deliver. This is supported by analysis undertaken by the Patented Medicines Price Review Board (PMPRB). Based on a 2017 report from the PMPRB, 82% of new drugs that entered the Canadian market between 2010 and 2017 were classified as offering little to no improvement over existing therapies, and only 5% were classified as breakthrough or had a substantial improvement over existing therapies. With this understanding, managed formularies are designed to bend the curve on drug spending by proactively encouraging the use of the most cost-effective treatments that generate value for both plan sponsors and plan member Under an open formulary, non-high-cost drugs approved by Health Canada are covered regardless of their cost or whether or not they provide any meaningful value over existing therapies. In 2019 79% of claimants belonged to a plan with an open formulary. The lack of adoption can be attributed to many reasons. One reason being the advisor community has not bought into the need for formularies. Even as drug costs skyrocket, group benefit advisors fail to successfully implement the most fundamental tool for cost containment. Call to action – learn more about what formularies insurers offer and how these can help employers save. Another reason is managing change. No one likes to change. Change is work for the benefits advisor, the plan sponsor, and the employees. Strong, effective communication is a must. The report notes the perception by plan sponsors that managed formularies severely restrict access to new and existing drugs. Many of those concerns are unfounded as the majority of drugs remain available as a general benefit and only a small subset are, in fact, a non-benefit. Ultimately adopting a managed formulary ensures better management of a small subset of drugs that are costlier than existing therapies but may not offer additional value, while still maintaining open access to the vast majority of drugs on the market Still need proof? Canadian guidelines recommend metformin (cost $.20/day) as the initial agent of choice for newly diagnosed type 2 diabetes patients. Open formulary plan designs render factors like affordability irrelevant because they make all agents available at any point in the treatment journey without regard to cost-effectiveness. That is, a newly diagnosed patient could bypass metformin and/or sulfonylureas ($0.15/day) and start treatment with a costlier SGLT-2 inhibitor or a GLP-1 agonist ($2.70/day to $7.88/day) in the absence of valid clinical rationale for doing so. Emerging and future trends notes are Pharmacogenomics, Value Based Pharmacy (VBP), and Gene Therapy Pharmacogenomics: Pharmacogenomics is an exciting new field that has the potential to transform the way many common medications are prescribed. A form of personalized medicine, pharmacogenomics is based on the principle that certain genetic mutations have been shown to influence the metabolism of drugs. The goal of pharmacogenomics is to predict patient response to medications, including the potential to avoid negative side-effects. Based on pharmacogenomic information, a physician or pharmacist can initiate or modify medications that are best suited for a particular individual. The HMB+ study showed that patients whose medication treatment is optimized and guided by the results of their pharmacogenomic test can achieve better outcomes compared with patients whose treatment relies purely on clinical (i.e., pharmacist and physician) judgment. It lends support for the inclusion of pharmacogenomics in benefit plans for specific clinical scenarios to optimize patient health outcomes. That sounds great – sign me up! Not so fast. Health data is some of the most valuable and thus susceptible to cyberattacks. One must ensure that health data is sufficiently protected. Another issue is privacy. Earlier this year the Supreme Court of Canada upheld the genetic non-discrimination law which ensures Canadians can take genetic tests without being disadvantaged for insurance. But what if that changes? VBP: an important, though often overlooked determinant of success are the health care professionals themselves, specifically pharmacists. As medication therapy experts, pharmacists play an essential role in ensuring that patients’ drug therapies are safe and effective, managing patient adherence, and improving health outcomes. HBM+ implemented a VBP Program in 2018. Through the VBP Program, pharmacies in Canada (except Quebec) that submit claims to HBM+ are evaluated for the quality of care that they deliver to patients based on eight validated, evidence-based, quality-of-care measures. Gene Therapy can be considered a new paradigm in drug development that will yield hundreds of new treatments in the coming years. In fact, within the next two years, the number of approved gene therapies worldwide is expected to double. The majority of these are in the oncology space with two-thirds of active clinical trials in 2019 looking at leukemia, lymphoma, and solid tumors, but there are notable developments in treatments for cardiovascular disease, endocrine and metabolic disease, blood disorders, and ophthalmology. End. Comments are closed.

|